"SaaS churn valuation" is a make-or-break factor for founders looking to raise, exit, or simply grow sustainably.

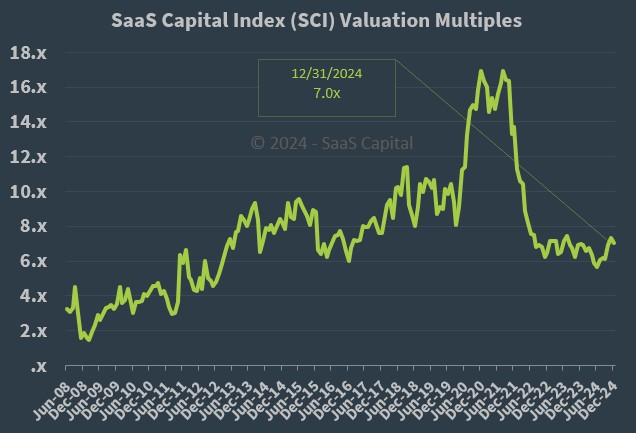

Earlier this year, SaaS companies with churn rates above 10% were seeing their valuations drop by up to 40%.

As of July 2025, we're seeing PE firms and strategic buyers walk away from deals if SaaS churn isn't below a set percentage, even when revenue growth is strong.

Investors want predictable revenue, and churn disrupts that.

If you cannot control churn, your SaaS is worth less. Not worthless. Just worth less.

When I speak to SaaS founders about churn, the same concern comes up repeatedly.

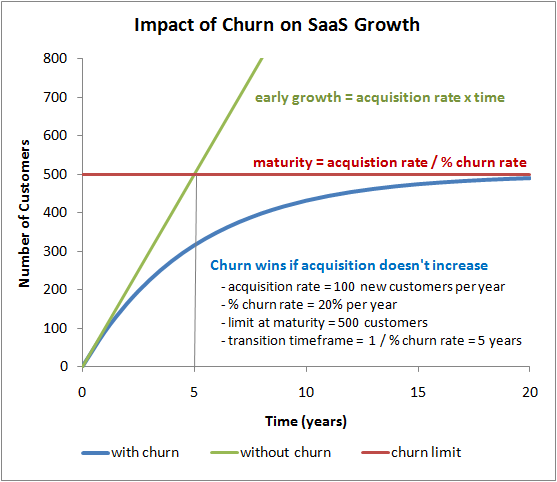

They worry that no matter how much they grow, churn will quietly eat away at their revenue.

I've found that even a small reduction in churn can have a massive impact on valuation multiples.

While churn is an inescapable part of running a SaaS business, there is no reason it should destroy your growth potential.

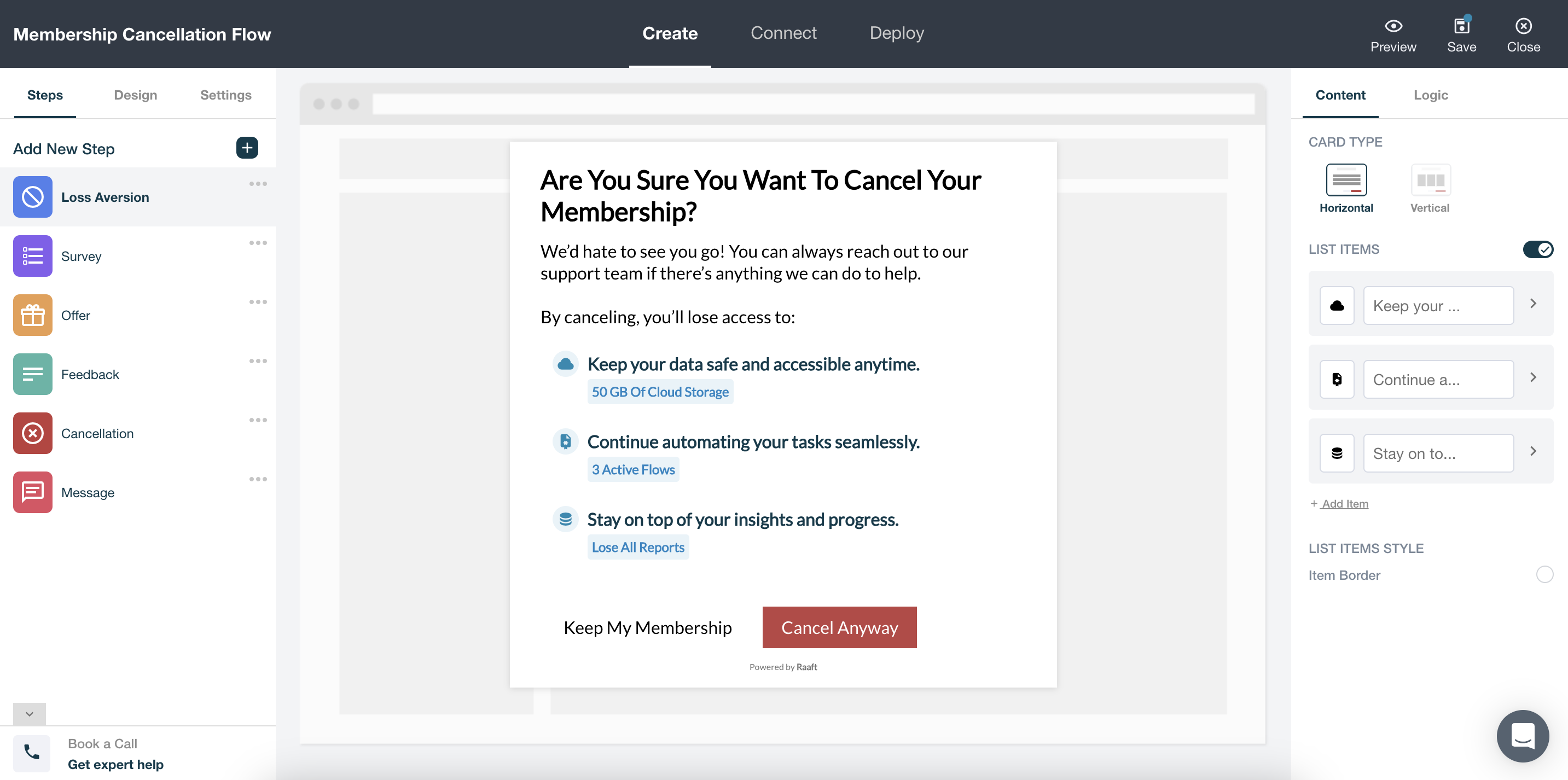

As users head toward the exit door, effective cancellation flows can act as a safety net to catch revenue before it disappears.

I've seen founders double their valuations just by optimizing customer retention.

Are you losing high-value customers every month? Struggling to pinpoint why users are canceling? Worried that churn is cutting your valuation in half?

Let’s break down how SaaS churn impacts valuations and what you can do about it.

We’ve Found Churn Is Increasingly Destructive To SaaS Valuations

SaaS churn refers to the percentage of customers who cancel their subscriptions over a given period.

If 5 out of 100 customers leave in a month, your churn rate is 5%.

It sounds small, but over a year, that can mean losing more than half your customer base if left unchecked.

When I first started working with SaaS founders, many underestimated the long-term impact of churn.

But here’s the ugly truth: investors notice churn immediately.

If your churn rate is high, they see your business as unstable and risky.

If it is low, you are building a predictable revenue engine that deserves a premium valuation.

How I'm Seeing Churn Affect SaaS Valuations In 2025

In 2025, SaaS valuations are directly tied to customer retention.

SaaS companies with churn below 5% are securing exit multiples of 8-12x revenue.

Companies with churn between 5-10% are seeing valuations fall to 5-7x revenue.

Anything above 10% churn, and you are lucky to get 3-4x revenue.

I recently spoke to a founder who grew revenue from $2M to $5M in two years.

Despite the growth, their high churn meant investors only offered a 4x multiple.

Why?

Because every dollar of growth was leaking out the back door.

Why Investors Keep Asking About Churn

Investors want to know their money is safe.

High churn means future revenue is unpredictable.

If 20% of your customers are leaving each year, they have to trust you will constantly replace them just to stand still.

That is a risky bet, and they will lower their valuation to protect themselves.

On the flip side, low churn tells investors you have product-market fit.

It shows them that customers are getting value and will stick around.

The lower your churn, the higher the confidence and the higher the multiple.

How I'm Helping SaaS Teams Reduce Churn And Boost

If you want a higher exit multiple, focus on reducing churn.

The first step is to understand why customers are leaving.

Most SaaS teams guess, but you need real data.

When I worked with a SaaS company struggling with churn, we implemented a simple cancellation flow to capture exit feedback.

Within a month, we discovered that 30% of cancellations were due to a missing feature.

Prioritizing that feature reduced churn by 25% and increased their valuation multiple by 3x.

Raaft makes it easy to capture and act on customer feedback.

Raaft allows you to create customizable cancellation flows, gather feedback, and present tailored offers to retain users.

It is one of the simplest ways to reduce churn and protect your valuation.

Why SaaS Teams Should Care About Churn Now

This year, we’ve seen SaaS exits get more competitive.

Investors have options, and they will always choose the business with better retention.

If you are planning to exit in the next 12-24 months, now is the time to get churn under control.

Small changes today can mean millions in added valuation later.

And here is the thing: reducing churn is not just about the exit.

It makes your business stronger, more predictable, and easier to scale.

Why I Recommend Raaft For SaaS Teams

If you are serious about increasing your SaaS valuation, start by reducing churn.

Raaft makes it easy to build effective cancellation flows, collect feedback, and retain more customers.

I have seen firsthand how the right tool can transform a SaaS business.

Do not let churn hold you back.

Take control today, and position your SaaS for the best possible exit tomorrow.

Use Raaft today free and see the difference it makes.

Offboarding Cheatsheet

This framework + video tutorial will help you design a better cancellation process.

Some of our featured articles

Miguel Marques

Miguel Marques

Miguel Marques

Customer Success insights in your inbox

Helping Founders and Customer Success Managers handle customer retention effectively.

We will only ever send you relevant content. Unsubscribe anytime.

![Best Customer Survey Platforms: Here Are My 4 Favorites [2025 Research]](https://raaft-website.s3.amazonaws.com/img/blog/thumbnails/best-customer-survey-platforms.png)