Understanding how to calculate the cost of acquisition is critical to the SaaS business model. You must know how much it will cost to acquire users in your target market. Once you have this data, this will inform your go-to-market strategy. While many startups have solved the product-market fit problem, they still fail because they cannot affordably acquire new users.

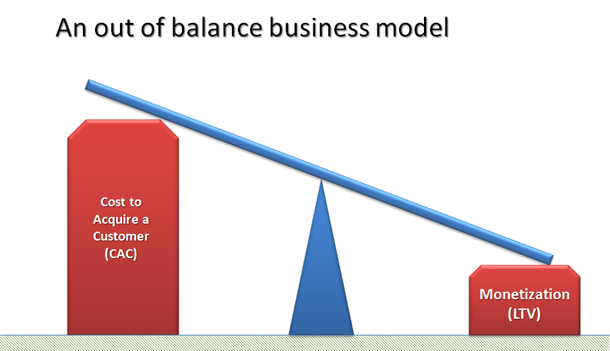

The cost of acquiring new users can be a startup killer. That’s the harsh reality. If you can’t make the numbers work, it will be impossible to grow your SaaS startup beyond a certain point. When the cost of acquisition turns out to be higher than expected, this can make it impossible to monetize your user base and become a profitable business.

In this article, we are going to break down how to calculate the cost of acquisition. With a core understanding of your customer acquisition costs, you will be able to ensure you have a viable business model. The cost to acquire customers (CAC) may also dictate how far you need to monetize customers (through lifetime value) to see a return on your investment.

For instance, if you know it will cost $100 to acquire a new user for your SaaS solution, how long will it be before you receive $100 from the user under a subscription-based model? The sooner you’re able to reclaim the money you spent to acquire the new user, the better. If it’s going to take several transactions for you to reclaim this money, the CAC could be a killer.

How do you calculate cost of acquisition?

To calculate cost of acquisition, you must divide the total cost of your campaign spend by the number of new users acquired from the same campaign. It’s really that simple. If you’re using multiple marketing channels to acquire new users, the CAC is likely to vary because some channels may be more cost-effective than others at acquiring new users.

CAC = Total Cost Of Sales & Marketing / # Of Customers Acquired

While customer acquisition costs are a concern in any industry, it’s vital to analyze them in the SaaS world because the model is reliant upon the lifetime value of a customer. If you’re actively pouring money into acquiring new customers, you need to know how many months it will take before you see a full return on your investment. This is something you must be measuring.

In some cases, it can take longer to recover CAC and begin to profit than you might think. Even with hefty costs attached to acquiring new users, it’s possible to optimize CAC and make the economics more favorable. When you’re identifying ideal customer profiles (ICPs) and buyer personas, you must also be thinking about the potential CPC in tandem.

When you’re exploring high value customer personas and measuring their price sensitivity, you may discover that high value customer personas may be too costly to acquire and maintain. In contrast, users acquired under a freemium model may place a burden on your revenue model. By knowing your CAC, you will understand what your margins will look like as you grow.

Why is cost of acquisition important?

The success of your SaaS startup depends on you knowing these numbers. Ultimately, this will help to prevent your business dying from its own inefficiencies. CAC must always be lower than the LTV. When it exceeds the LTV, you will run into problems. As we said earlier, if you cannot make these numbers work, it won’t be long before you run out of money in the pursuit of growth.

You should aim to recover the cost of acquisition within 12 months. If it takes longer to see a return on your investment, this could raise serious questions about the sustainability of your business model. You need to see a return on your investment as quickly as possible because this will give you the capital needed to continue fuelling your growth campaigns.

What is a good CAC for SaaS?

The SaaS industry benchmark for LTV:CAC is 3:1. If you spend $100 to acquire a new user, you should aim to earn at least $300 from them. 4:1 or higher is an indication of a strong business model that will usually intrigue investors. At the same time, if your ratio is higher than 5:1, this may be a sign that you could be growing faster and you’re under-investing in user acquisition.

The lower the CAC for your business, the better. You want to be acquiring high value customers at the cheapest possible price. To optimize your ability to acquire high value customers, you will likely have to experiment with multiple marketing and sales channels. For instance, you may discover that it’s cheaper to acquire users through email outreach than Facebook advertising.

You’re either spending too much on acquiring customers or not enough. Finding a balance between the two is crucial to driving sustainable growth. If you’re not spending enough on acquisition, you could be missing out on opportunities as a result. It all comes down to A/B testing. You will learn more about optimizing your campaigns around efficiency as you go.

What metrics are important for SaaS companies?

Fundamentally, we believe that customer lifetime value and the cost of acquisition are the most important metrics for SaaS companies to track. Alongside simply tracking these two metrics, you must understand how they relate to each other. As you embark on leveraging various marketing channels to drive growth, you should track the CAC for each channel.

To successfully make sure your customer lifetime value is as high as possible, you should be focused on preventing churn and driving customer retention. Low churn is essential to building a sustainable SaaS business. Fortunately, there are tools on the market that can support you in driving customer retention and increasing the lifetime value of your customer base.

If you’re looking for ways to boost your customer LTV, you should start by getting the right systems in place to prevent churn and drive customer retention. Try Raaft for free today.

Offboarding Cheatsheet

This framework + video tutorial will help you design a better cancellation process.

Some of our featured articles

Miguel Marques

Miguel Marques

Miguel Marques

Customer Success insights in your inbox

Helping Founders and Customer Success Managers handle customer retention effectively.

We will only ever send you relevant content. Unsubscribe anytime.